Attention, ages 20-30

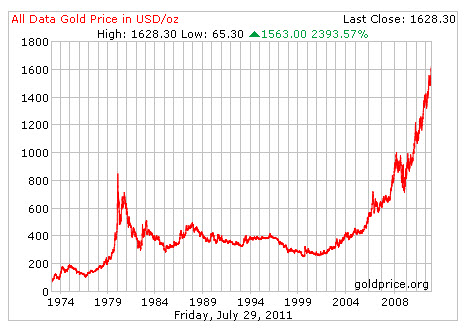

Your ability to save money by collecting on interest has been significantly curtailed.

Placing your money in savings accounts, certificates of deposits, or money-market funds will only yield you a loss, as inflation robs you of your future savings.

Good luck playing on the stock and bonds market. Hope you studied finance and have enough capital to lose during your inevitable trial-and-error phase. Hey, maybe you could hire a financial manager! Shouldn't cost too much!

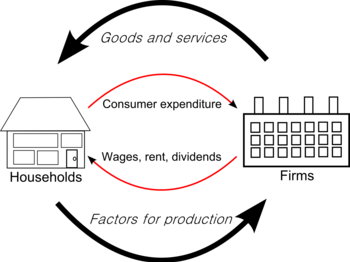

You can thank the Federal Reserve for its bang-up job in "saving" the economy. According to its estimates and stimulus, the economy should be exploding in growth today.

Saving Capitalism from Itself,

The Federal Reserve

Placing your money in savings accounts, certificates of deposits, or money-market funds will only yield you a loss, as inflation robs you of your future savings.

Good luck playing on the stock and bonds market. Hope you studied finance and have enough capital to lose during your inevitable trial-and-error phase. Hey, maybe you could hire a financial manager! Shouldn't cost too much!

You can thank the Federal Reserve for its bang-up job in "saving" the economy. According to its estimates and stimulus, the economy should be exploding in growth today.

Saving Capitalism from Itself,

The Federal Reserve