barackattack wrote:Stalin: given your name I'm not surprised to see that you clearly relish the idea of capitalist regimes collapsing.

Governments and central banks stand back and do nothing = major financial institutions collapsing and triggering a recession/depression.

Governments and central banks helping out = prevent the collapse of financial institutions so that we all live to fight another day.

Hey, an ad hominem attack! That didn't take long.

Business busts aren't prevented by active intervention on part of governments and central banks; otherwise, any country with a central bank and government would never experience a bust. Business cycles are influenced by decisions within the private and public sector. Depending on the history of these interactions, the path is paved toward a boom and its boost, which vary in length and intensity.

People act surprised when a depression/recession follows from a boom like the one in the US of roughly 2000 to early 2007. What happens when the central bank lowers interest rates (from late 1990s and throughout the 2000s) and when the government provides banks the moral hazard to lend money to risky borrowers for houses (since 1996)? You get a distorted capital structure that isn't sustainable. This inevitably leads to a bust, and now the government steps in again, jacks up the supply of money, and reduces interest rates.

Now, there's talk of Obamacare and increasing taxes. This uncertainty distorts the value of future cash flows, so businesses will continue sitting on their cash until the government becomes certain about something. Otherwise, this recession will continue. Note that the government needs to raise taxes and reduce spending from all the bailouts it performed (and for its planned Obamacare program). That's not sound economic policy. You're preventing a collapse, prolonging the recession, and then extracting more wealth from the economy for most likely decades afterward. In the long-run, that's detrimental to the citizens.

Are you starting to see how this process works?

Look at the onset of a depression in 1980 or 1890. In 1890, the government did nothing, the economy tanked for a year, but people stabilized it, and the economy continued to grow. No intervention was necessary. Look at 1980. Volkner had two options: 1) flood the market with cheap money (i.e. bailouts, maintain current employment levels, and get his Keynesian on), or 2) let interest rates rise but let unemployment increase in the short-run.

He chose 2, which many economists attribute as a starting point of a generally long, stable period of economic growth in the US. The US got out of that recession with 2-3 years IIRC. What did Obama and Bernanke do? They chose 1, and here we are in a recession after 5 years with no end in sight because of too much government uncertainty.

There's plenty of instances of state intervention from the government and central bank, but the history of their interactions with the private sectors and teh outcome of those actions really matter. Without understanding that, you're just a mouthpiece of bad propaganda. You're merely presuming that you know you're typing about...

barackattack wrote:Sure, take some time to figure out who's to blame and impose sanctions (e.g. impose harsh austerity on fovernments???? ;3). But wait until after the crisis to conduct this time-consuming and distracting task.

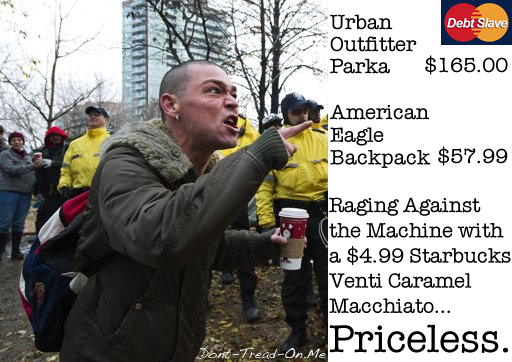

Enjoy praising the arsonist for putting out the fire which he started earlier.