Attention, ages 20-30

Moderator: Community Team

48 posts

• Page 1 of 2 • 1, 2

Attention, ages 20-30

Your ability to save money by collecting on interest has been significantly curtailed.

Placing your money in savings accounts, certificates of deposits, or money-market funds will only yield you a loss, as inflation robs you of your future savings.

Good luck playing on the stock and bonds market. Hope you studied finance and have enough capital to lose during your inevitable trial-and-error phase. Hey, maybe you could hire a financial manager! Shouldn't cost too much!

You can thank the Federal Reserve for its bang-up job in "saving" the economy. According to its estimates and stimulus, the economy should be exploding in growth today.

Saving Capitalism from Itself,

The Federal Reserve

Placing your money in savings accounts, certificates of deposits, or money-market funds will only yield you a loss, as inflation robs you of your future savings.

Good luck playing on the stock and bonds market. Hope you studied finance and have enough capital to lose during your inevitable trial-and-error phase. Hey, maybe you could hire a financial manager! Shouldn't cost too much!

You can thank the Federal Reserve for its bang-up job in "saving" the economy. According to its estimates and stimulus, the economy should be exploding in growth today.

Saving Capitalism from Itself,

The Federal Reserve

-

BigBallinStalin

BigBallinStalin

- Posts: 5151

- Joined: Sun Oct 26, 2008 10:23 pm

- Location: crying into the dregs of an empty bottle of own-brand scotch on the toilet having a dump in Dagenham

Re: Attention, ages 20-30

You're ignoring the flip side of this. We are paying close to no interest for houses, cars, etc that are financed. I would say for the majority of people (not to mention the majority in the age 20-30 bracket) this has a bigger impact than a higher interest rate on savings would have. I'd rather have .5% interest on my savings account, 3.5% mortgage interest and 3% auto loan interest than having higher savings interest and higher loan interest.

I'm not saying keeping rates super low is the best thing to do (I'm no economist) but I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

EDIT: I am outside this age range (added as a disclaimer)

I'm not saying keeping rates super low is the best thing to do (I'm no economist) but I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

EDIT: I am outside this age range (added as a disclaimer)

-

Ace Rimmer

Ace Rimmer

- Posts: 1911

- Joined: Mon Dec 01, 2008 1:22 pm

Re: Attention, ages 20-30

Ace Rimmer wrote:You're ignoring the flip side of this. We are paying close to no interest for houses, cars, etc that are financed. I would say for the majority of people (not to mention the majority in the age 20-30 bracket) this has a bigger impact than a higher interest rate on savings would have. I'd rather have .5% interest on my savings account, 3.5% mortgage interest and 3% auto loan interest than having higher savings interest and higher loan interest.

I'm not saying keeping rates super low is the best thing to do (I'm no economist) but I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

EDIT: I am outside this age range (added as a disclaimer)

doesn't help those of us who busted our butts and paid off everything either though... hell, I just finished paying off my wife's last student loan... and yet my investments are growing slower that the money I've been throwing into them

John Adams wrote:I have come to the conclusion that one useless man is called a disgrace, that two are called a law firm, and that three or more become a Congress! And by God I have had this Congress!

-

fadedpsychosis

fadedpsychosis

- Posts: 180

- Joined: Mon Oct 01, 2007 4:12 pm

- Location: global

Re: Attention, ages 20-30

Ace Rimmer wrote:You're ignoring the flip side of this. We are paying close to no interest for houses, cars, etc that are financed. I would say for the majority of people (not to mention the majority in the age 20-30 bracket) this has a bigger impact than a higher interest rate on savings would have. I'd rather have .5% interest on my savings account, 3.5% mortgage interest and 3% auto loan interest than having higher savings interest and higher loan interest.

I'm not saying keeping rates super low is the best thing to do (I'm no economist) but I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

EDIT: I am outside this age range (added as a disclaimer)

This.

I'm in this age range.

fac vitam incredibilem memento vivere

Knowledge Weighs Nothing, Carry All You Can

-

IcePack

IcePack

- Multi Hunter

- Posts: 16835

- Joined: Wed Aug 04, 2010 6:42 pm

- Location: California

Re: Attention, ages 20-30

Yes, inflation is good if you are in debt.

However, if-

you don't have a .5% interest rate here, you have a -2.5% real rate. You'd be wise to do something else with that money than let it sit in a savings account to die. You're losing money man, and getting nothing in return for it.

Because you are in debt.

I know your not going to pay any attention, but here it is anyway. You will find it in your best interests to get out of debt and stay out of debt. Time's running out. The things about the monetary system that you think favor you, are unsustainable. When our system resets, and it will reset, people like you will be in a very bad jam.

But hey, continue on as you see best for yourself, I wish nothing but good luck, sir.

However, if-

Ace Rimmer wrote: I'd rather have .5% interest on my savings account,

you don't have a .5% interest rate here, you have a -2.5% real rate. You'd be wise to do something else with that money than let it sit in a savings account to die. You're losing money man, and getting nothing in return for it.

Ace Rimmer wrote: I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

Because you are in debt.

I know your not going to pay any attention, but here it is anyway. You will find it in your best interests to get out of debt and stay out of debt. Time's running out. The things about the monetary system that you think favor you, are unsustainable. When our system resets, and it will reset, people like you will be in a very bad jam.

But hey, continue on as you see best for yourself, I wish nothing but good luck, sir.

-

patches70

patches70

- Posts: 1664

- Joined: Sun Aug 29, 2010 12:44 pm

Re: Attention, ages 20-30

BigBallinStalin wrote:Your ability to save money by collecting on interest has been significantly curtailed.

Placing your money in savings accounts, certificates of deposits, or money-market funds will only yield you a loss, as inflation robs you of your future savings.

Good luck playing on the stock and bonds market. Hope you studied finance and have enough capital to lose during your inevitable trial-and-error phase. Hey, maybe you could hire a financial manager! Shouldn't cost too much!

You can thank the Federal Reserve for its bang-up job in "saving" the economy. According to its estimates and stimulus, the economy should be exploding in growth today.

Saving Capitalism from Itself,

The Federal Reserve

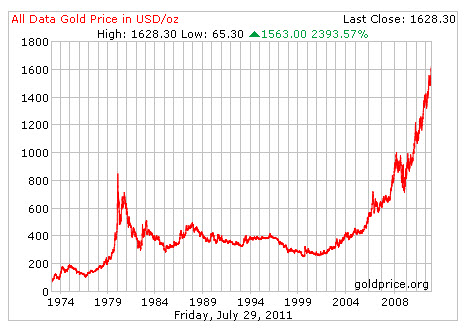

Good Luck with this. I have been ringing the bell since 1999, but who wanted an ounce of silver for 3$?

-

Phatscotty

Phatscotty

- Posts: 3714

- Joined: Mon Dec 10, 2007 5:50 pm

Re: Attention, ages 20-30

Something tells me that in spite that inflation is higher than savings ratings, most people who have money is still waiting on the sidelines with it. There's so much uncertainty.

Is the economic-outlook always like this? And old person could answer this.

Is the economic-outlook always like this? And old person could answer this.

el cartoncito mas triste del mundo

-

nietzsche

nietzsche

- Posts: 4597

- Joined: Sun Feb 11, 2007 1:29 am

- Location: Fantasy Cooperstown

Re: Attention, ages 20-30

patches70 wrote:Yes, inflation is good if you are in debt.

However, if-Ace Rimmer wrote: I'd rather have .5% interest on my savings account,

you don't have a .5% interest rate here, you have a -2.5% real rate. You'd be wise to do something else with that money than let it sit in a savings account to die. You're losing money man, and getting nothing in return for it.Ace Rimmer wrote: I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

Because you are in debt.

I know your not going to pay any attention, but here it is anyway. You will find it in your best interests to get out of debt and stay out of debt. Time's running out. The things about the monetary system that you think favor you, are unsustainable. When our system resets, and it will reset, people like you will be in a very bad jam.

But hey, continue on as you see best for yourself, I wish nothing but good luck, sir.

Ace, Patches is 100% correct.

I've posted this vid a few times over the last 6 months, but I highly recommend you take 5 minutes out and view it

Last edited by Phatscotty on Mon Sep 17, 2012 5:33 pm, edited 1 time in total.

-

Phatscotty

Phatscotty

- Posts: 3714

- Joined: Mon Dec 10, 2007 5:50 pm

Re: Attention, ages 20-30

Army of GOD wrote:BBS, can you be my financial adviser for free please?

I can be your financial adviser.

Advice: don't do anything for the money. If you run our of money borrow it. When you've been in bankrupcy 3-4 times, come here, I'll teach to to fish.

el cartoncito mas triste del mundo

-

nietzsche

nietzsche

- Posts: 4597

- Joined: Sun Feb 11, 2007 1:29 am

- Location: Fantasy Cooperstown

Re: Attention, ages 20-30

The best way I've seen to get a decent rate of return on your money, is to own a successful business.

-

Timminz

Timminz

- Posts: 5579

- Joined: Tue Feb 27, 2007 1:05 pm

- Location: At the store

Re: Attention, ages 20-30

Ace Rimmer wrote:You're ignoring the flip side of this. We are paying close to no interest for houses, cars, etc that are financed. I would say for the majority of people (not to mention the majority in the age 20-30 bracket) this has a bigger impact than a higher interest rate on savings would have. I'd rather have .5% interest on my savings account, 3.5% mortgage interest and 3% auto loan interest than having higher savings interest and higher loan interest.

I'm not saying keeping rates super low is the best thing to do (I'm no economist) but I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

EDIT: I am outside this age range (added as a disclaimer)

Sure, benefits and costs matter, but...

Hey, remember the housing crisis? Guess what predominantly caused that?

Hey, remember the bust from previous overinvestment in auto manufacturing? Guess what predominantly caused that?

Oh, wait! How the hell are people going to pay for these things in the future when so many alternatives of extremely safe forms of savings have been rendered unprofitable?

Then, how will all the deficit spending and reckless monetary policy be eventually paid for? (1) Through inflation and (2) through more instability in the economy as relatively safer savings are rednered less profitable--or at a loss.

So, you're right in that you might get a cheaper car or house at the cost of inherent instability in the economy, increased uncertainty, $1.6 trillion of excess reserves just waiting to be released, and then the following boom and bust with its decreased job security, unemployment, wage cuts, capacity to save money for hard times, etc.

All because... hey, mortgage rates for cars and houses are great when they're so low? It's not good in the long-run. Not good at all, my friend.

Last edited by BigBallinStalin on Mon Sep 17, 2012 6:46 pm, edited 1 time in total.

-

BigBallinStalin

BigBallinStalin

- Posts: 5151

- Joined: Sun Oct 26, 2008 10:23 pm

- Location: crying into the dregs of an empty bottle of own-brand scotch on the toilet having a dump in Dagenham

Re: Attention, ages 20-30

What BBS is trying to say that there are not many incentives to earn and save money?

el cartoncito mas triste del mundo

-

nietzsche

nietzsche

- Posts: 4597

- Joined: Sun Feb 11, 2007 1:29 am

- Location: Fantasy Cooperstown

Re: Attention, ages 20-30

nietzsche wrote:What BBS is trying to say that there are not many incentives to earn and save money?

Cheaper, safer, and moderately profitable alternatives to saving for the everyday man and woman, who possess hardly any knowledge of finance, have been eliminated by the ongoing series of expansionary monetary policy.

There are incentives to earn and save money. You could keep your money in the bank and let it depreciate as the inflation rate rises. So, later, you're left with less money in real terms. Or, you could invest it in riskier assets--e.g. playing "lol i dunno wat im doin" on the stock market!

-

BigBallinStalin

BigBallinStalin

- Posts: 5151

- Joined: Sun Oct 26, 2008 10:23 pm

- Location: crying into the dregs of an empty bottle of own-brand scotch on the toilet having a dump in Dagenham

Re: Attention, ages 20-30

comments by hawt chiks

side note: Player once guaranteed that QE3 would never happen. IMO Operation twist was QE3 and now this is 4, and others view this as QE5....see how bad this is getting?

side note: Player once guaranteed that QE3 would never happen. IMO Operation twist was QE3 and now this is 4, and others view this as QE5....see how bad this is getting?

-

Phatscotty

Phatscotty

- Posts: 3714

- Joined: Mon Dec 10, 2007 5:50 pm

Re: Attention, ages 20-30

Army of GOD wrote:BBS, can you be my financial adviser for free please?

Haha, NO!

If you don't have a significant amount of disposable income, then you don't have much of a chance now. The prices on precious metals, stocks, and bonds have been driven up--largely from an expansive monetary policy created by the Federal Reserve. I'd recommend investing in your brain.

Witness the rising prices in these financial sectors. This is inflation. New credit is dumped into these markets--see especially the housing mortgages. Which reminds me:

As the rates of interest fall for these loans, then the profits for banks would fall from these loans... how would banks make up for this loss? By seeking substitutes! Investing in riskier financial assets and/or by charging more fees from its consumers! Yay!

-

BigBallinStalin

BigBallinStalin

- Posts: 5151

- Joined: Sun Oct 26, 2008 10:23 pm

- Location: crying into the dregs of an empty bottle of own-brand scotch on the toilet having a dump in Dagenham

Re: Attention, ages 20-30

nietzsche wrote:Something tells me that in spite that inflation is higher than savings ratings, most people who have money is still waiting on the sidelines with it. There's so much uncertainty.

Is the economic-outlook always like this? And old person could answer this.

Some people forget, or are rationally ignorant, nietz. Dangle "cheap" houses and cars in their faces, and you're bound to get elected. Hey, how healthy is your hair? You want to be a politician?

We'll have sax work with ya too.

-

BigBallinStalin

BigBallinStalin

- Posts: 5151

- Joined: Sun Oct 26, 2008 10:23 pm

- Location: crying into the dregs of an empty bottle of own-brand scotch on the toilet having a dump in Dagenham

Re: Attention, ages 20-30

Timminz wrote:The best way I've seen to get a decent rate of return on your money, is to own a successful business.

-

BigBallinStalin

BigBallinStalin

- Posts: 5151

- Joined: Sun Oct 26, 2008 10:23 pm

- Location: crying into the dregs of an empty bottle of own-brand scotch on the toilet having a dump in Dagenham

Re: Attention, ages 20-30

I gotta say I like your 3 last posts BBS. They sound completely rational and centered.

I don't want to read the refutes that will follow because I don't want to learn they are not correct.

This thread is over for me.

EDIT: you fast posted me, I mean the 3 posts before the response to Timminz. That guy is ugly.

I don't want to read the refutes that will follow because I don't want to learn they are not correct.

This thread is over for me.

EDIT: you fast posted me, I mean the 3 posts before the response to Timminz. That guy is ugly.

el cartoncito mas triste del mundo

-

nietzsche

nietzsche

- Posts: 4597

- Joined: Sun Feb 11, 2007 1:29 am

- Location: Fantasy Cooperstown

Re: Attention, ages 20-30

Timminz wrote:The best way I've seen to get a decent rate of return on your money, is to own a successful business.

meh....or sit back and do nothing....

let your mind do all the work

Last edited by Phatscotty on Mon Sep 17, 2012 7:19 pm, edited 1 time in total.

-

Phatscotty

Phatscotty

- Posts: 3714

- Joined: Mon Dec 10, 2007 5:50 pm

Re: Attention, ages 20-30

i have been thinking about this over the past few months... i'm considering investing in some kind of precious metal once i get my student loans paid off and get a decent amount of cash in the bank. i've also dabbled in forex.

BBS (or whomever else thinks they have a good answer): what should i do with my money to protect it from the stoopid fagets that run our economy? and why? the OP is basically a hate letter, but it doesn't really give any solutions...

BBS (or whomever else thinks they have a good answer): what should i do with my money to protect it from the stoopid fagets that run our economy? and why? the OP is basically a hate letter, but it doesn't really give any solutions...

natty_dread wrote:Do ponies have sex?

(proud member of the Occasionally Wrongly Banned)Army of GOD wrote:the term heterosexual is offensive. I prefer to be called "normal"

-

john9blue

john9blue

- Posts: 1268

- Joined: Mon Aug 20, 2007 6:18 pm

- Location: FlutterChi-town

Re: Attention, ages 20-30

john9blue wrote:i have been thinking about this over the past few months... i'm considering investing in some kind of precious metal once i get my student loans paid off and get a decent amount of cash in the bank. i've also dabbled in forex.

BBS (or whomever else thinks they have a good answer): what should i do with my money to protect it from the stoopid fagets that run our economy?

silver dimes, quarters, 50 cent pieces.... junk silver..off ebay. Honestly, metals are really high now (never been higher

-

Phatscotty

Phatscotty

- Posts: 3714

- Joined: Mon Dec 10, 2007 5:50 pm

Re: Attention, ages 20-30

Phatscotty wrote:Timminz wrote:The best way I've seen to get a decent rate of return on your money, is to own a successful business.

meh....or sit back and do nothing....

let your mind do all the work

Speculating is an easy way to make a good return, in hindsight. Going forward, I would recommend owning a successful business.

-

Timminz

Timminz

- Posts: 5579

- Joined: Tue Feb 27, 2007 1:05 pm

- Location: At the store

Re: Attention, ages 20-30

BigBallinStalin wrote:Ace Rimmer wrote:You're ignoring the flip side of this. We are paying close to no interest for houses, cars, etc that are financed. I would say for the majority of people (not to mention the majority in the age 20-30 bracket) this has a bigger impact than a higher interest rate on savings would have. I'd rather have .5% interest on my savings account, 3.5% mortgage interest and 3% auto loan interest than having higher savings interest and higher loan interest.

I'm not saying keeping rates super low is the best thing to do (I'm no economist) but I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

EDIT: I am outside this age range (added as a disclaimer)

Sure, benefits and costs matter, but...

Hey, remember the housing crisis? Guess what predominantly caused that?

Hey, remember the bust from previous overinvestment in auto manufacturing? Guess what predominantly caused that?

Oh, wait! How the hell are people going to pay for these things in the future when so many alternatives of extremely safe forms of savings have been rendered unprofitable?

Then, how will all the deficit spending and reckless monetary policy be eventually paid for? (1) Through inflation and (2) through more instability in the economy as relatively safer savings are rednered less profitable--or at a loss.

So, you're right in that you might get a cheaper car or house at the cost of inherent instability in the economy, increased uncertainty, $1.6 trillion of excess reserves just waiting to be released, and then the following boom and bust with its decreased job security, unemployment, wage cuts, capacity to save money for hard times, etc.

All because... hey, mortgage rates for cars and houses are great when they're so low? It's not good in the long-run. Not good at all, my friend.

But BBS, don't we want economy and we can't have economy unless we spend more money!

-

thegreekdog

thegreekdog

- Posts: 7246

- Joined: Thu Jul 17, 2008 6:55 am

- Location: Philadelphia

Re: Attention, ages 20-30

thegreekdog wrote:BigBallinStalin wrote:Ace Rimmer wrote:You're ignoring the flip side of this. We are paying close to no interest for houses, cars, etc that are financed. I would say for the majority of people (not to mention the majority in the age 20-30 bracket) this has a bigger impact than a higher interest rate on savings would have. I'd rather have .5% interest on my savings account, 3.5% mortgage interest and 3% auto loan interest than having higher savings interest and higher loan interest.

I'm not saying keeping rates super low is the best thing to do (I'm no economist) but I do much better off personally by having low interest rates on loans and zero interest rates on my savings.

EDIT: I am outside this age range (added as a disclaimer)

Sure, benefits and costs matter, but...

Hey, remember the housing crisis? Guess what predominantly caused that?

Hey, remember the bust from previous overinvestment in auto manufacturing? Guess what predominantly caused that?

Oh, wait! How the hell are people going to pay for these things in the future when so many alternatives of extremely safe forms of savings have been rendered unprofitable?

Then, how will all the deficit spending and reckless monetary policy be eventually paid for? (1) Through inflation and (2) through more instability in the economy as relatively safer savings are rednered less profitable--or at a loss.

So, you're right in that you might get a cheaper car or house at the cost of inherent instability in the economy, increased uncertainty, $1.6 trillion of excess reserves just waiting to be released, and then the following boom and bust with its decreased job security, unemployment, wage cuts, capacity to save money for hard times, etc.

All because... hey, mortgage rates for cars and houses are great when they're so low? It's not good in the long-run. Not good at all, my friend.

But BBS, don't we want economy and we can't have economy unless we spend more money!

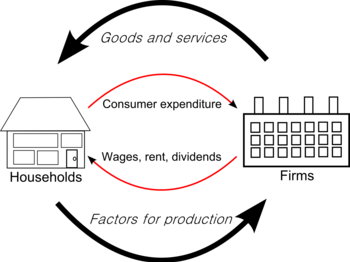

You're right, TGD. It's all about Circular Flow.

(What's missing?)

(Time. Interest. Present savings which leads to future spending).

-

BigBallinStalin

BigBallinStalin

- Posts: 5151

- Joined: Sun Oct 26, 2008 10:23 pm

- Location: crying into the dregs of an empty bottle of own-brand scotch on the toilet having a dump in Dagenham

48 posts

• Page 1 of 2 • 1, 2

Who is online

Users browsing this forum: No registered users