https://www.forbes.com/sites/conormurray/2023/03/10/what-to-know-about-silicon-valley-banks-collapse-the-biggest-bank-failure-since-2008/?sh=1c3a7ff63a21

SVB reported $212 billion in assets for the fourth quarter of 2022, making it the second-largest bank failure in U.S. history, second only to Washington Mutual, whose 2008 failure came as the bank had roughly $300 billion in assets. Silicon Valley Bank ranked as the 16th-largest bank in the United States based on assets prior to its collapse.

KEY BACKGROUND

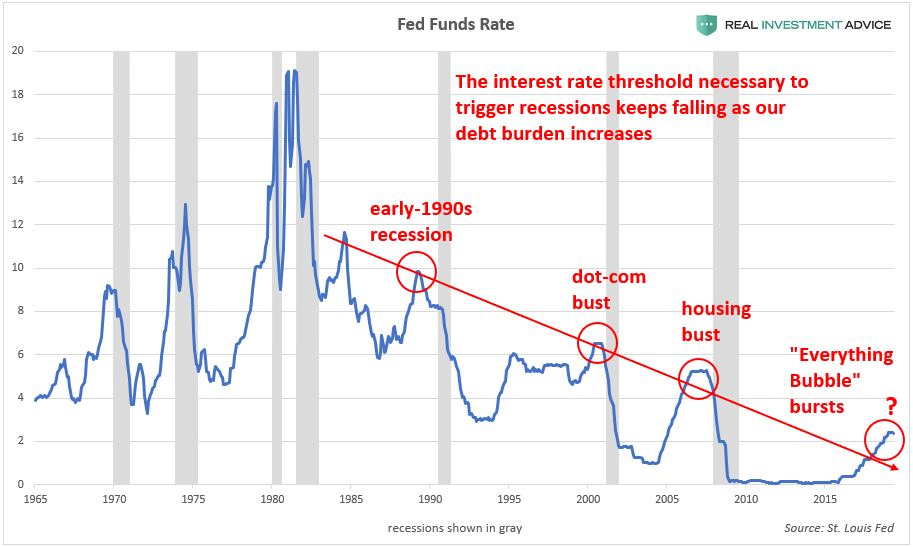

After the tech industry grew during the pandemic, SVB’s clients deposited billions, bringing the bank from $60 billion in total deposits at the end of the first quarter 2020 to nearly $200 billion two years later. While deposits came in, SVB invested in debt like U.S. Treasuries and mortgage-backed securities, but as the Federal Reserve began to increase interest rates to combat inflation, the value of SVB’s investments fell. Higher interest rates also took a toll on SVB’s clients: Startup funding began to dry up as private fundraising became more costly, causing its clients to withdraw funds. Amid the surge in withdrawals, SVB sold assets (including bonds that had lost value due to interest rate increases) which created $1.8 billion in losses.

TANGENT

The failure of both SVB on Friday and cryptocurrency bank Silvergate on Wednesday sparked fears of contagion and drew uncomfortable comparisons to the Great Recession. Some analysts agree contagion concerns are overblown in light of “idiosyncratic issues at individual banks,” Bank of America analyst Ebrahim Poonawala said, as SVB and Silvergate primarily operated within industries vulnerable to higher interest rates (cryptocurrencies, startups and venture capital) and many banks have broader customer bases. But shares of some of the nation’s largest banks, including JPMorgan, Wells Fargo and Citigroup, were up Friday after slumping on Thursday.